Debt Collection Defense: Understanding Your Rights and Options

Understanding Debt Collection Defense

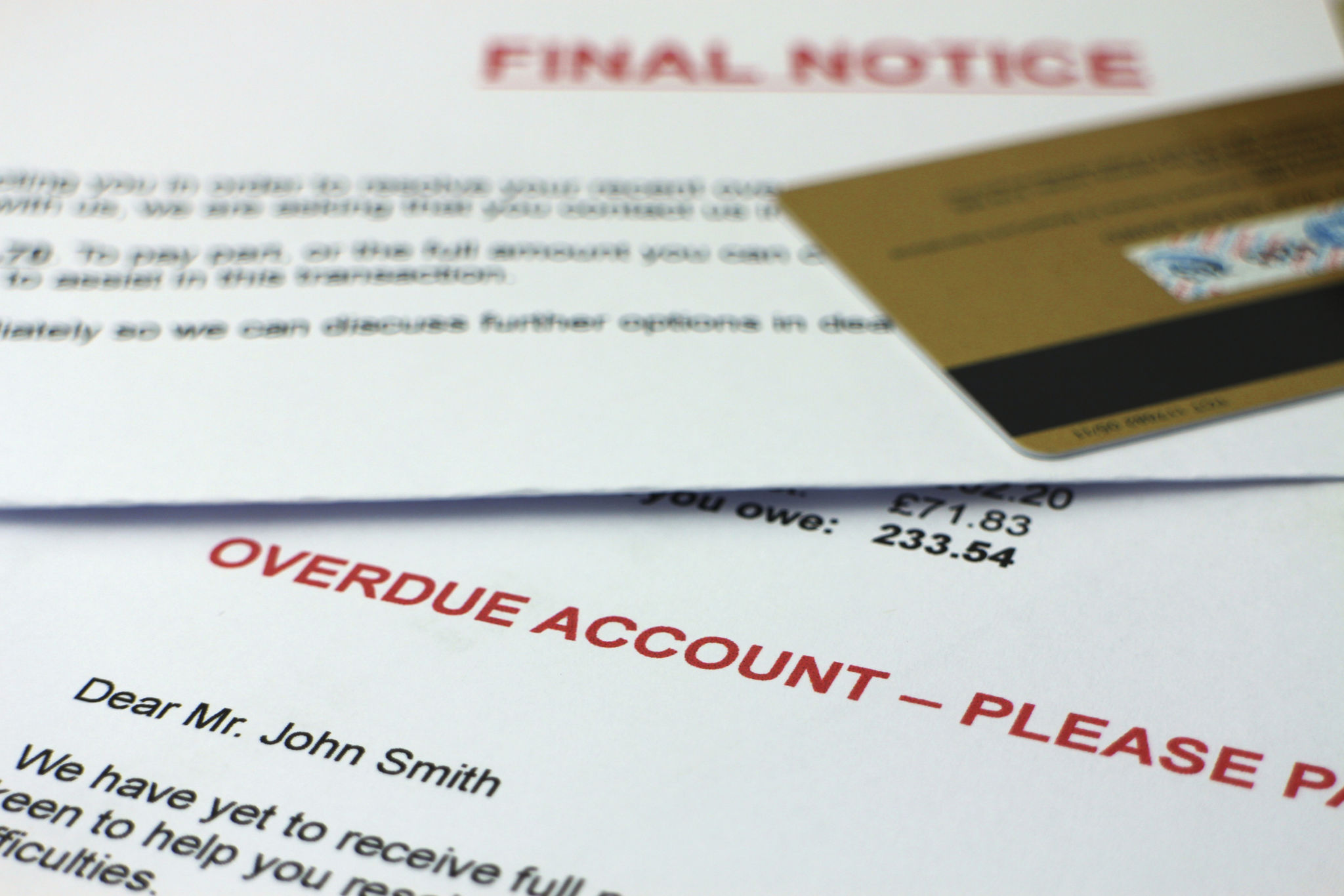

Dealing with debt collectors can be overwhelming and stressful. However, understanding your rights and the options available to you can make a significant difference in how you handle such situations. Knowing that you have legal protections in place can empower you to manage debt collection processes confidently.

Your Rights Under the Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides consumers with protections against abusive, unfair, or deceptive practices by debt collectors. This law applies to personal, family, and household debts, covering credit card debt, auto loans, medical bills, and mortgages.

Under the FDCPA, debt collectors are prohibited from using abusive language, making false statements, or calling at unreasonable hours. You also have the right to request that a debt collector cease communication with you. Understanding these rights can help you respond appropriately if you feel a collector is overstepping boundaries.

Steps to Take When Contacted by a Debt Collector

If you're contacted by a debt collector, it's essential to stay calm and gather information. Here are some steps you can take:

- Request written validation of the debt.

- Verify the legitimacy of the debt and the collector.

- Keep detailed records of all communication.

By following these steps, you can ensure that you are dealing with legitimate debts and avoid falling victim to scams.

Options for Resolving Debt

Once you've verified a legitimate debt, explore your options for resolution. These may include:

- Negotiating a payment plan or settlement with the creditor.

- Seeking assistance from a credit counseling service.

- Considering debt consolidation to manage multiple debts more effectively.

Each option has its pros and cons, so it's essential to evaluate your financial situation and choose an approach that aligns with your goals.

Legal Assistance and Defense Strategies

If you believe a debt collector has violated your rights or if you're facing a lawsuit, consulting with a lawyer specializing in debt collection defense can be beneficial. Legal professionals can help you build a strong defense, potentially resulting in the dismissal of the case or more favorable terms.

The Importance of Proactive Communication

One of the best strategies for managing debt is proactive communication. Reach out to creditors before accounts become delinquent to discuss potential hardships. Many creditors are willing to work with you to find a mutually beneficial solution when approached openly and honestly.

Conclusion: Empower Yourself with Knowledge

Understanding your rights and options in debt collection defense can significantly impact your financial well-being. By knowing how to navigate interactions with debt collectors and exploring available solutions, you can reduce stress and work towards resolving outstanding debts effectively. Remember, you are not alone—resources and professionals are available to guide you through this challenging process.