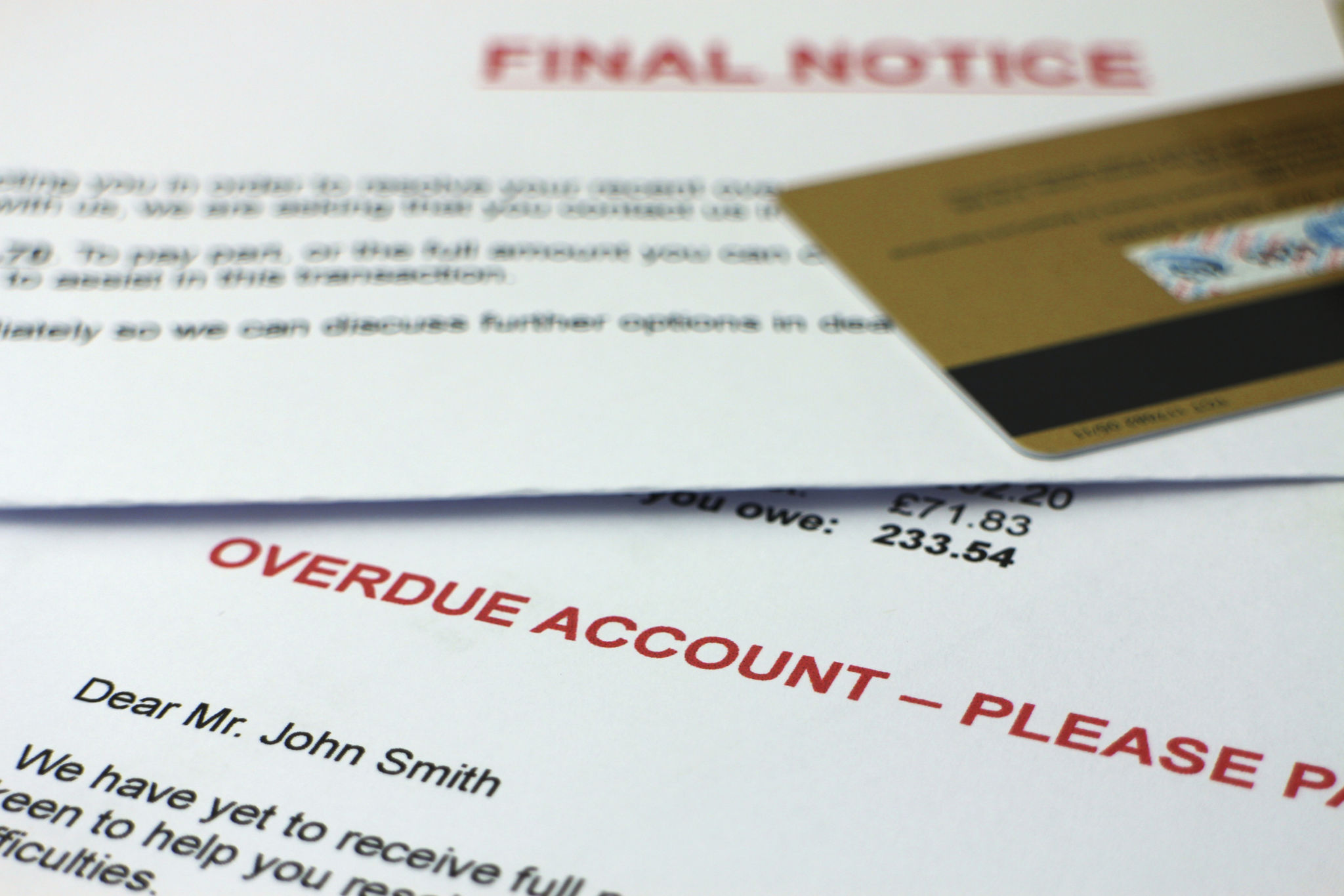

Defending Against Debt Collectors: Key Strategies and Legal Rights

Understanding Debt Collection and Your Rights

Debt collection can be a daunting experience, especially if you're unsure about your rights and how to handle the situation. Understanding the basics of debt collection and the protections available to you is crucial. The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive debt collection practices. Knowing your rights under this law can help you manage interactions with debt collectors more effectively.

Under the FDCPA, debt collectors are prohibited from using deceptive or unfair practices when collecting debts. They must provide you with a written notice of the debt, including the amount owed and the creditor's name. If you believe the debt is not yours, you have the right to dispute it within 30 days of receiving this notice. During this period, the debt collector must cease collection efforts until the debt is verified.

Strategies for Dealing with Debt Collectors

Keep Records of Communication

One of the most effective strategies in dealing with debt collectors is maintaining thorough records of all communications. Keep copies of letters, emails, and notes of phone conversations, including dates, times, and the names of representatives you spoke with. This documentation can be invaluable if disputes arise or if you need to verify your interactions with the collector.

Communicate in Writing

Whenever possible, communicate with debt collectors in writing. This not only provides a record of your interactions but also allows you to clearly outline your position. If a debt collector is harassing you, request in writing that they stop contacting you. Under the FDCPA, they must comply with this request, though they can still take legal action if they choose.

Legal Options and When to Seek Help

Consulting a Lawyer

If you're being harassed by a debt collector or if they violate your rights under the FDCPA, consulting with a lawyer who specializes in consumer rights can be beneficial. A lawyer can help you understand your legal options and may even assist in filing a lawsuit against the collector for damages if appropriate.

Filing a Complaint

If you believe a debt collector has violated your rights, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state's attorney general's office. These agencies have the authority to investigate complaints and take action against collectors who violate consumer protection laws.

Staying Proactive in Managing Debt

The best defense against aggressive debt collection is proactive management of your debts. Create a budget that allows for regular payments on outstanding debts and seek assistance from credit counseling services if needed. These services can help you develop a plan to manage your finances and negotiate with creditors.

Remember that while debt collection can be stressful, understanding your rights and taking proactive steps can significantly reduce the anxiety associated with it. By staying informed and prepared, you can effectively defend yourself against unfair collection practices and work towards resolving your debts.