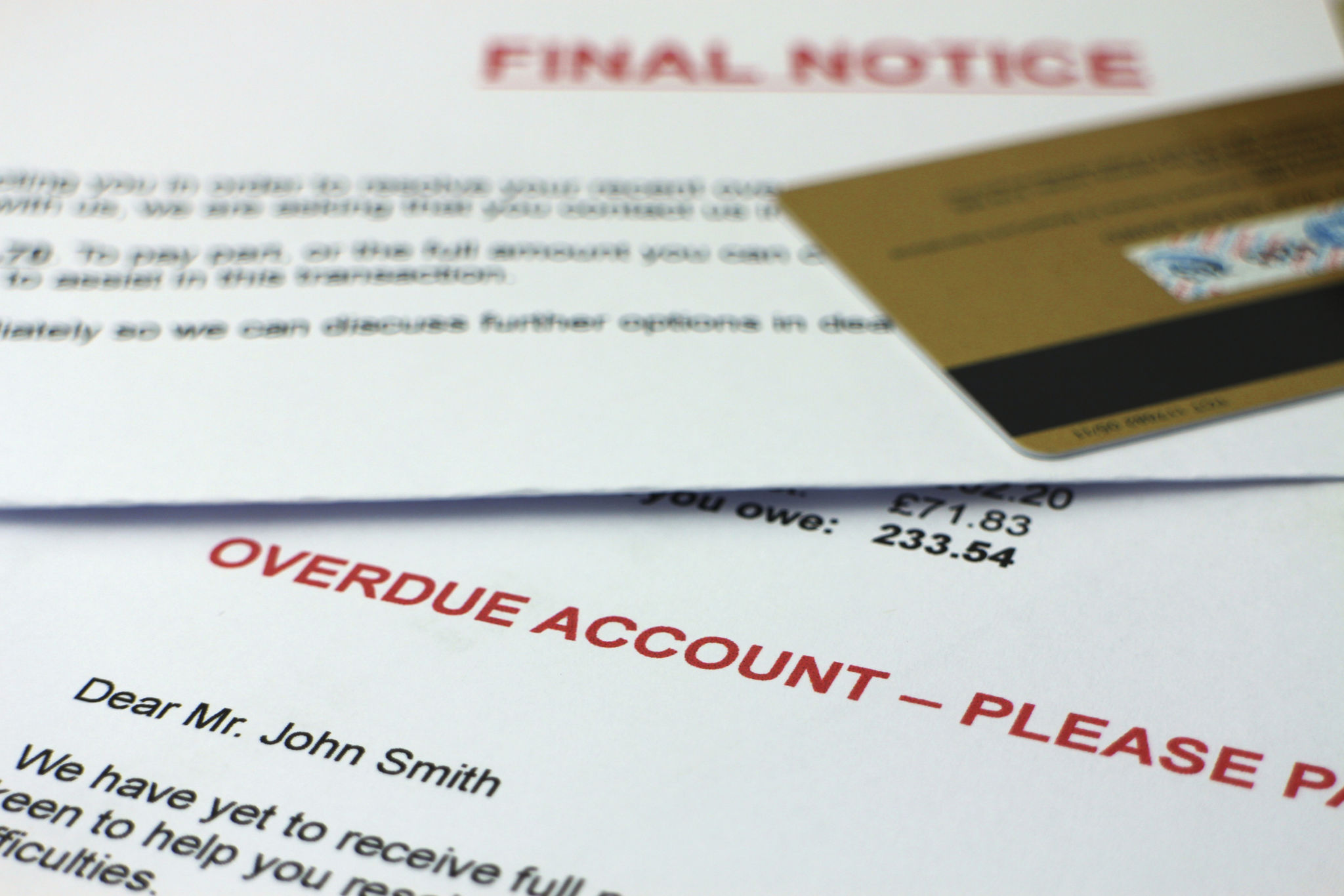

How to Defend Against Aggressive Debt Collectors: A Strategic Guide

Understanding Your Rights

Dealing with debt collectors can be intimidating, especially when they become aggressive. However, it's crucial to know that you have rights protected by the Fair Debt Collection Practices Act (FDCPA). This federal law ensures that debt collectors treat you fairly and prohibits certain abusive practices. Familiarizing yourself with these rights can empower you to stand your ground confidently.

Under the FDCPA, debt collectors are not allowed to harass, oppress, or abuse you in any way. They also cannot make false statements about your debt or threaten you with actions they cannot legally take. Understanding these protections can give you a significant advantage in handling aggressive tactics.

Document Every Interaction

One of the most effective strategies to defend yourself is thoroughly documenting every interaction with debt collectors. Keep records of all communications, noting dates, times, and the content of your conversations. If possible, communicate in writing to create a paper trail that can serve as evidence if the situation escalates.

It is also beneficial to request written verification of the debt from the collector. This request can be made within 30 days of their first contact. By obtaining and reviewing this information, you can ensure the debt is valid and correctly attributed to you.

Communicate Clearly and Calmly

While dealing with an aggressive debt collector, it's essential to remain calm and composed. Clear communication can often defuse tension and help you manage the situation effectively. When speaking with collectors, state your position clearly and assertively without resorting to hostility.

If a collector becomes threatening or uses foul language, remind them of your rights under the FDCPA. You have the right to end any conversation that becomes abusive, and you can report such behavior to relevant authorities.

Seek Professional Advice

If you're feeling overwhelmed or unsure about handling aggressive debt collectors, seeking professional advice is a wise step. Financial advisors or attorneys who specialize in consumer rights can provide guidance tailored to your situation.

These professionals can help you understand the legal landscape and offer strategies to protect your interests. They may also communicate with collectors on your behalf, providing an added layer of protection.

Know When to Report

If a debt collector's behavior violates your rights, it's important to report them to the appropriate authorities. You can file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state's attorney general's office. These organizations can investigate your claims and take action against abusive practices.

Additionally, consider reporting any violations to the Federal Trade Commission (FTC). Your reports can contribute to broader efforts in regulating debt collection practices and protecting consumers nationwide.

Consider Settlement Options

If you're able, consider negotiating a settlement with the debt collector. Many collectors are willing to accept a reduced amount if it means they will recover some of the money owed. Before entering negotiations, assess your financial situation and determine what you can realistically afford to pay.

When negotiating, ensure any agreement reached is documented in writing. This documentation will protect you from future claims that more money is owed.

Conclusion

Defending against aggressive debt collectors requires a strategic approach centered on knowledge, documentation, and clear communication. By understanding your rights and knowing when to seek help or report misconduct, you can navigate these challenging situations with confidence and protect your financial well-being.